The problem with fixed budgets

The traditional approach to preparing an annual budget is simply taking last year’s actuals as a baseline. An uplift or adjustment is then applied based on the organisation’s strategic focus for the year, as well as economic factors such as inflation and market demand.

This method can be quite sound in helping organisations measure themselves and control spending, particularly for businesses that are quite static or generally smaller in nature. However, in today’s economic and competitive environment, this method tends to fall short and can no longer be justified.

As soon as the 2 – 3 month budget process is set, the budget will already be outdated and paint an incorrect picture of where the organisation is heading for the next 12 months.

There is no doubt an annual yardstick should be created. However this should only form part of an ongoing planning process – a rolling forecast. This will allow management to better focus and react to changes in order to meet short and mid-term goals.

While most businesses do re-forecast, it is generally still bound to their existing 12 month annual fixed budget. In reality there are no yearly boundaries, and in today’s fast moving and dynamic environment, the organisations that succeed are the ones that forecast continuously, use up-to-date business drivers, plan collaboratively and do scenario modelling on a regular basis.

Inherent issues with traditional budgeting

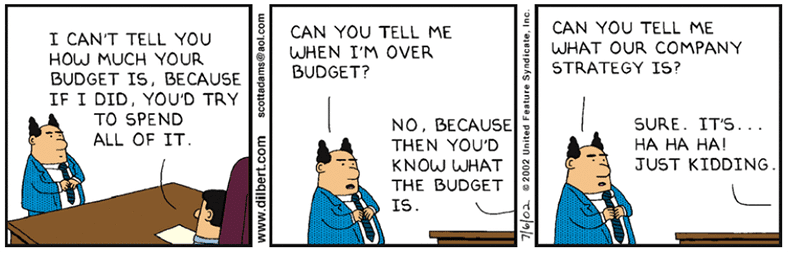

Inherent problems with traditional budgeting approaches include the inability to effectively communicate financial expectations as they quickly become out of sync with the strategic plan of the organisation.

Worse still, they often do not promote the right behaviours, as sales and financial targets are at times deliberately lowered to mask the actual appearance of performance, and budgeted costs are increased to ensure a larger share of the cost allocations.

As with any plan, it is common sense that if the situation changes, you should update your plan accordingly.

Traditional budgeting is generally quite rigid and fixed, but during the budget year if you have more information and you would do your budget differently because of this information, then why would you not change it?

One of the key reasons is generally time and effort as the traditional approach is very time consuming and often feels like you are herding animals, trying to get budget owners to complete their portion. The budget period generally takes 3 months of being mired in complex spreadsheets, so why go through that pain it all over again?

Surely there is a better way, and certainly the organisations that have figured this out tend to perform better and stay ahead of the curve.

The modern approach

By leveraging technology and moving away from error prone, manual and inefficient spreadsheets, organisations can significantly modernise the way they budget, forecast and plan.

You can reduce planning or budgeting cycles significantly by taking out the labour intensive components, budget at an aggregated or detailed level (top down/bottom up), conduct rolling forecasts, promote the right behaviours and better align budgeting with strategy through scorecarding.

The Return on Investment for a planning tool is definite, and can be seen in as little as 3 months. To modernise your approach and take budgeting and planning for your organisation to the next level, start by exploring market leading software such as Adaptive Insights and IBM Planning Analytics (TM1).

If you’re interested in moving away from traditional budgeting approaches and exploring corporate Budgeting and Planning tools for your organisation, we can help. Our consultants are finance professionals, with a majority holding professional accounting qualifications (CA/CPA).

QMetrix has successfully implemented solutions for many organisations across industries, and can make a recommendation for a Budgeting and Planning tool that suits your unique organisation. Let’s chat.

This post was originally published on 22 April 2014 and updated since.