Was your experience with the most recent budgeting cycle positive or negative? Were you pulling your hair out by the end, or feeling burnt out and frustrated?

It may be worth taking a step back and assessing if the reason for this nightmare is due to an antiquated approach to budgeting and planning in general.

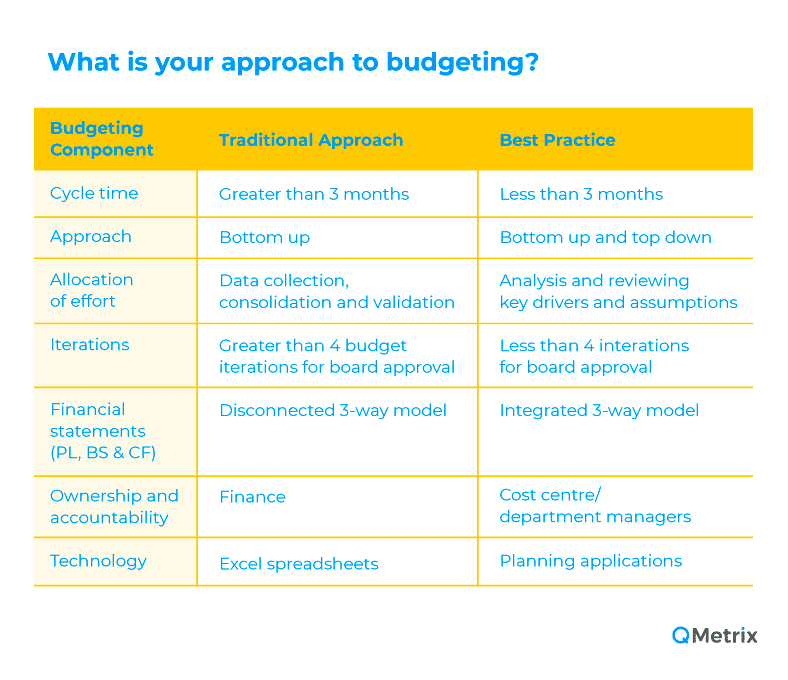

What is your approach to budgeting?

The table below outlines traditional budgets vs active planning (which is what top performing organisations are doing). See which bucket your organisation sits in to determine whether you are using an outdated approach or best practice approach.

If the profile of your most recent budget cycle looks more like the traditional approach, you are certainly not alone. In fact, most organisations are still stuck in the rut of doing classic ritualistic annual budgets for no other reason than it was always done that way.

In truth, organisations these days move and change quite quickly month to month and certainly from quarter to quarter, which means the traditional approach to planning is inadequate for managing business performance.

If you are sitting on the traditional approach side of the fence, have a think about your own budget that has been approved, it has likely become less relevant come the start of the financial year because you started the budget process months prior and things have changed.

This only adds to the frustration as the amount of man hours and effort that goes into preparing the annual budget doesn’t even culminate in something that is meaningful to use. And if it is being used – should it be?

Corporate budgeting, forecasting and planning are important exercises to ensure organisational resources can be allocated effectively in order to achieve its mission and objectives. However, it is only truly effective if it is being used and updated – continuously and by the entire business (not just finance bearing the burden).

Budgeting best practices

So how do I stop waking up from this nightmare in pools of sweat, or better yet – stop having nightmares about the annual budget cycle altogether?

Unfortunately, there is no silver bullet and as with most process improvement exercises, it takes a combination of people, process and technology.

The good news is – there is a way. Top performing organisations understand these challenges and generally nail these 3 key best practice aspects for budgeting and planning:

1. Move away from the granular detail

Focus on what really matters, think about your subsequent variance analysis. Chances are, you won’t have the time to go down to the detail in your analysis anyway. The more detail, the more complexity and time taken to complete each cycle – particularly if using the wrong technology.

As an example, for a recent manufacturing client we have been working with, it made absolutely no sense for them to plan down to each of their individual 200+ customers when the top 20 made up 80% of their sales.

2. Empower through reporting

As with most goals, there is no point completing it and then putting it on the shelf. Empower and enable your budget holders/contributors with the information they need to prepare and review their performance. They need to be able to see how they are tracking so they can adjust their plans accordingly and buy into the process.

In most cases, this is already happening with actual data, whether it is done through manual extracts from source systems or via existing Business Intelligence (BI) applications. Unfortunately though, budgets and actuals usually sit in different systems, which makes this quite difficult – see the next point.

3. Leverage technology

Move away from spreadsheets and leverage an integrated online planning application. Part of the reason most organisations are hamstrung with their planning and reporting process is that they are going in battle armed with kitchen utensils.

Make things easier for your users and reduce the use of unwieldy error prone spreadsheets. Unless you are a small business without many budget contributors or have a very simplistic business model, it is almost impossible to conduct dynamic and active planning without leveraging technology.

As a consultancy that specialises in implementing budgeting and forecasting solutions, we see a lot of organisations limping through using traditional spreadsheet tools for their enterprise planning. In the last decade, technology in this space has come in leaps and bounds to support FP&A teams and the finance team in general with better managing company performance.

Technology is a key aspect as mentioned in the third point above, but it also a key enabler in supporting the first and second points by assisting with both high-level top down and granular bottom up planning, as well as streamlining reporting and analysis.

At QMetrix we specialise with implementing both Adaptive Insights and IBM Planning Analytics (TM1). Both technologies are top tier in their standing as enterprise grade planning and reporting tools.

It is important to keep in mind technology will only get you part of the way (a long way for some), but good process is still equally important. Our consultants are both finance and IT professionals and can help you navigate the process, recommend a pragmatic course of action and provide industry best practice insights in this unique area of your business.

Your next budget cycle doesn’t have to be a nightmare. Set the wheels in motion – consider the above best practices and start to put the right processes in place to help make budget season 2020 better for everyone and yourself.

As a recap: